Private health insurance refers to health insurance strategies marketed by the private health insurance industry as a substitute for government-run insurance programs.

Who Controls Private insurance?

Although not government-run, private health insurance is highly regulated at the state and federal levels. Generally, regulations and laws often address what health care services individual and group health plans must cover. For example, maternity coverage and mental health parity are two long-standing regulatory requirements for private employer-sponsored group health plans.

Other plans, such as short-term, fixed indemnity, vision, dental, and critical illness policies, offer benefits, usually at low cost, but are also neither comprehensive as ACA-compliant medical plans nor count as coverage qualified—health plans under the ACA.

Cost of Private Health Insurance

Hence, the cost of purchasing private health insurance, that is, the premium, varies widely. So, factors that influence the cost of the premium include:

- The private health insurance plan you choose

- The insurer you choose,

- The number of people covered by the plan, and

- The plan purchase region.

Accordingly, for individual buyers, age and tobacco use are also into the cost of coverage. Therefore, employers tend to cover at least 50 percent of the premium costs for people who get their private health insurance through an employer.

How to Submit Your Articles

For Submitting Your Articles, you can email us at contact@womensdayblog.com

Why Write For Womens Day Blog – Private Health Insurance Write For Us

Search Terms Related to Private Health Insurance Write For Us

Insurance

Health Rik

Health system

Medical expenses

Payroll tax

Not to Profit

ERISA

Deductible

Out of pocket

Co-payment

Capitation

Search Terms for Private Health Insurance Write For Us

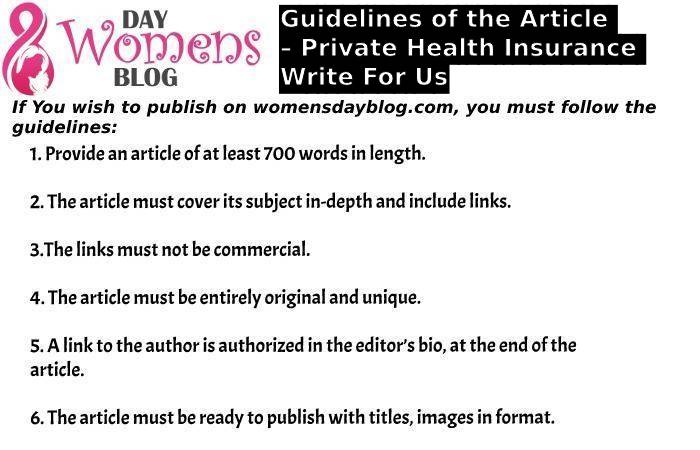

Guidelines of the Article – Private Health Insurance Write For Us

For Submitting Your Articles, you can email us at contact@womensdayblog.com